This is how you can increase your chances of success with startup investments tenfold!

In the exciting world of startup investing, there is one golden rule every investor should follow: diversification.

A diversified portfolio is crucial to maximizing the opportunities for high returns while minimizing risk.

A diversified portfolio is crucial to maximizing the opportunities for high returns while minimizing risk.

The importance of a diversified portfolio

Every experienced investor knows that diversification is the key to success.

By investing in many different startups, you spread the risk and at the same time increase the likelihood that one of these startups will become a huge success.

A single startup investment can multiply more than a hundredfold, but such cases are rare. Therefore, it is crucial to invest in a variety of startups to increase the chances of experiencing one of these rare successes.

By investing in many different startups, you spread the risk and at the same time increase the likelihood that one of these startups will become a huge success.

A single startup investment can multiply more than a hundredfold, but such cases are rare. Therefore, it is crucial to invest in a variety of startups to increase the chances of experiencing one of these rare successes.

Weigh up opportunities and risks

The more holdings an investor has, the greater his chances of a high return. Startups are inherently risky, and not every one will be successful. But successful investments can more than compensate for the less successful ones. By investing in many startups, the risk is spread across multiple projects. This reduces the overall risk of loss as a few successful startups are enough to offset the unsuccessful ones and generate a high return overall.

The principle of diversification works in startup investments just as it does in ETF savings plans. Just like with ETFs, you should invest in startups continuously and regardless of the current market situation to benefit from cost averaging. By investing regularly, you smooth out market fluctuations and optimize your long-term returns. Use the power of diversification and invest wisely!

The principle of diversification works in startup investments just as it does in ETF savings plans. Just like with ETFs, you should invest in startups continuously and regardless of the current market situation to benefit from cost averaging. By investing regularly, you smooth out market fluctuations and optimize your long-term returns. Use the power of diversification and invest wisely!

The secret of success of venture capital companies

Professional venture capital companies have long since internalized this strategy. They invest in a large number of startups because they know that it often only takes one or two very successful investments to significantly increase the overall portfolio return.

This practice clearly shows that diversification is the most effective way to achieve high returns while minimizing risk.

This practice clearly shows that diversification is the most effective way to achieve high returns while minimizing risk.

New opportunities for private individuals

Until now, it has been difficult for private individuals to build a diversified startup portfolio because large amounts of investment were required. But that has changed.

This also enables private individuals to build up a large portfolio and thus take advantage of the same opportunities for well above-average returns that were otherwise only reserved for professional investors.

Recommendations for a

successful portfolio

successful portfolio

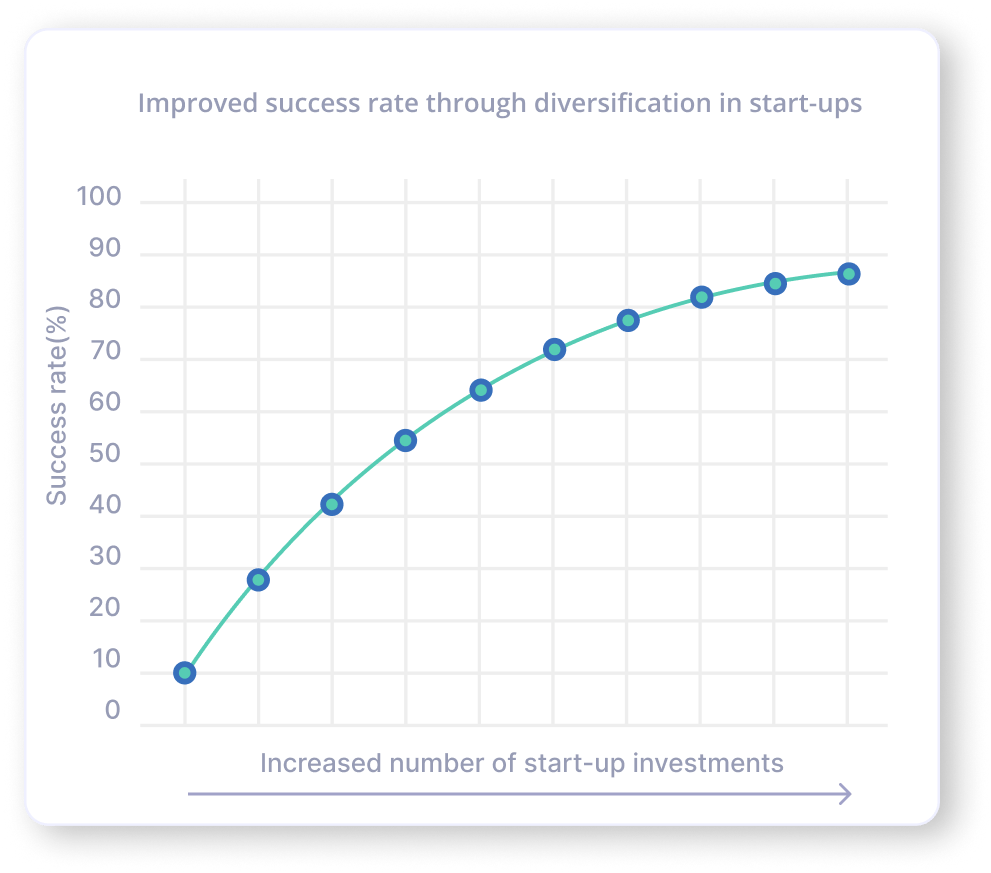

To maximize the chances of high returns, it is recommended to build a portfolio of at least 10 startups. A broad diversification of investments increases the likelihood that at least some of the startups will develop very successfully and have a positive impact on the overall performance of the portfolio.

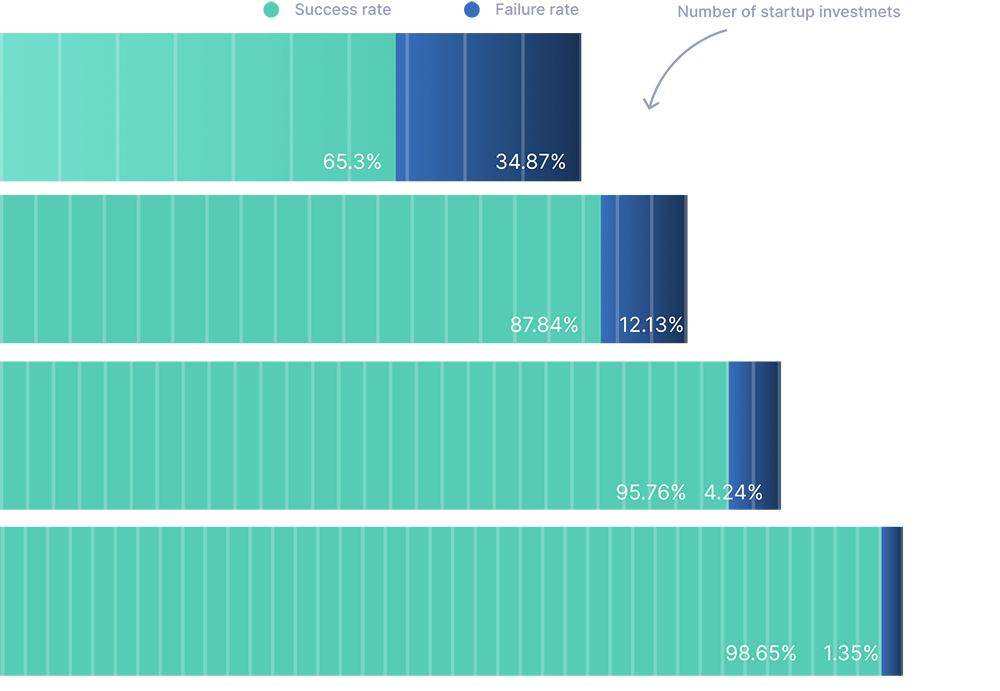

Studies show that a single startup has up to a 90% chance of failing. With intelligent diversification, you can significantly reduce this risk and maximize your chances of success:

- 10 startup investments of €250 each: The probability that all 10 will fail is 34.87%. This means your success rate is 65.13%.

- 20 startup investments of €250 each: The probability that all 20 will fail drops to around 12.16%. Your success rate increases to 87.84%.

- 30 startup investments of €250 each: The probability that all 30 investments will fail is only 4.24%. Your success rate is 95.76%.

- 40 startup investments of €250 each: The probability of all 40 failing is only 1.35%. Their success rate is an impressive 98.65%, almost 10x higher than a single startup investment.

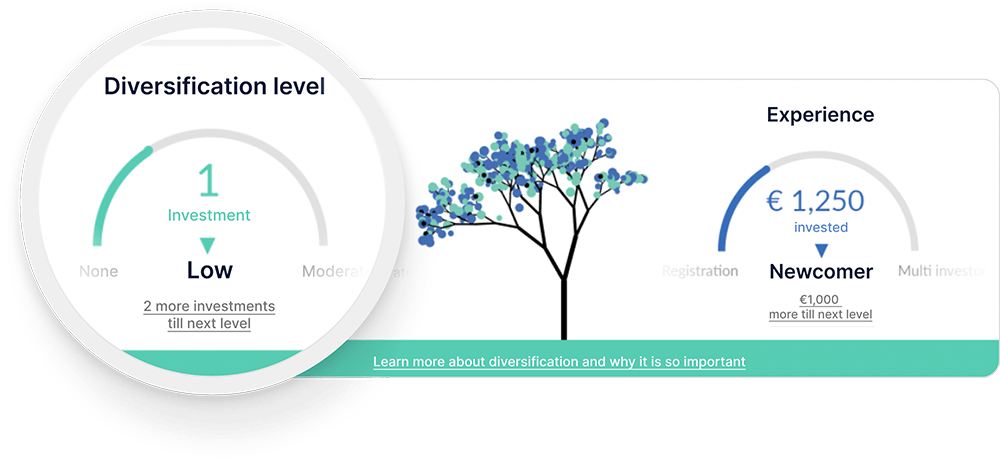

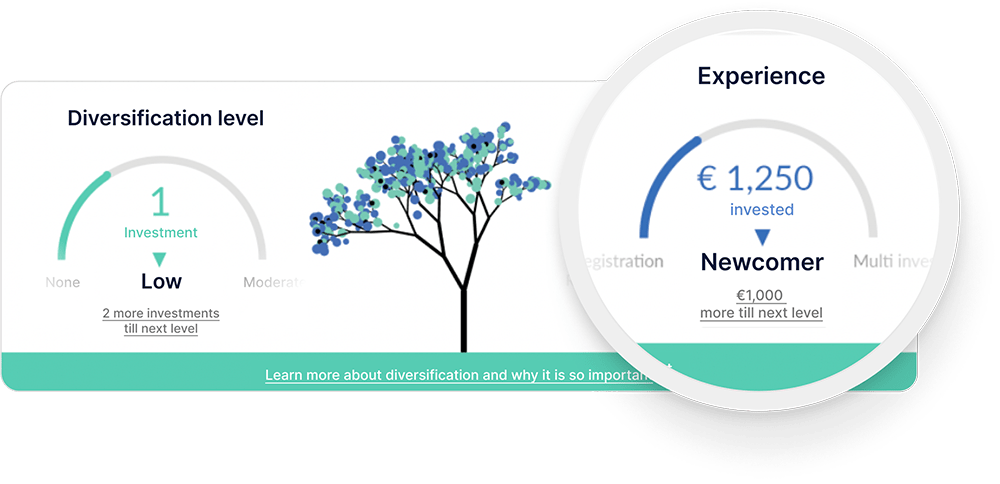

Diversification Widget

To give you an idea of how well diversified your startup portfolio is on Companisto, we show you a Diversification Widget on the dashboard.

This consists of three pieces of information:

This consists of three pieces of information:

Diversification Level

The Diversification Level shows you how well diversified your portfolio is.

It is based on the number of your startup investments.

It is based on the number of your startup investments.

Experience Level

The Experience Level gives you an indication of your experience with startup investments.

It is based on the amount you have invested.

It is based on the amount you have invested.

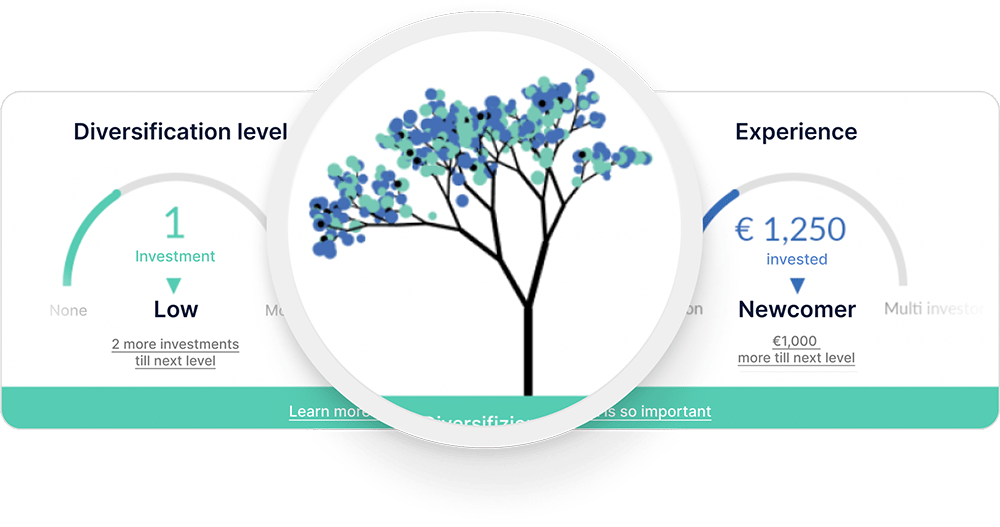

Diversification Tree

The Diversification Tree is an illustration of a combination of diversification level and experience level.

Build a diversified startup portfolio now and multiply your chance of returns!

Investment Opportunities